Hennes & Mauritz AB Chairman Stefan Persson’s continued share purchases have revived speculation he may be trying to take the global retail giant private, as the market tries to interpret the billionaire’s actions.

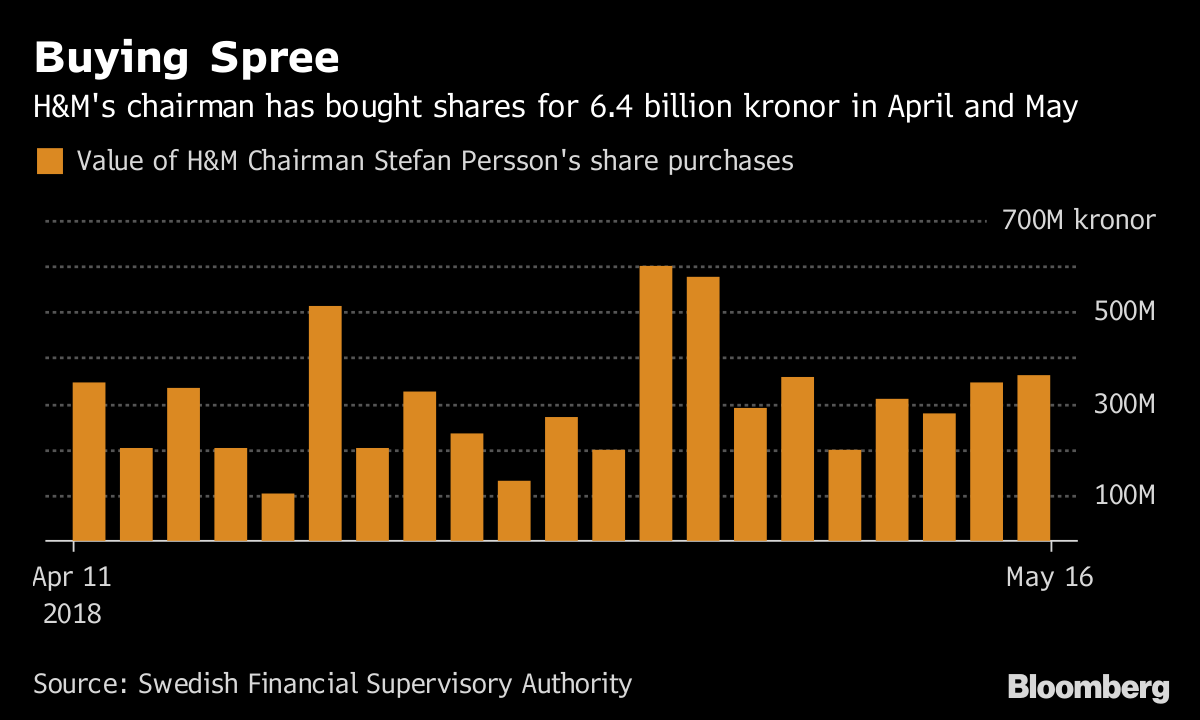

So far in May, Persson has spent about 3.5 billion kronor ($401 million) on H&M shares, bringing his stake to roughly 736 million shares. Year-to-date, he’s spent about 6.4 billion kronor buying stock.

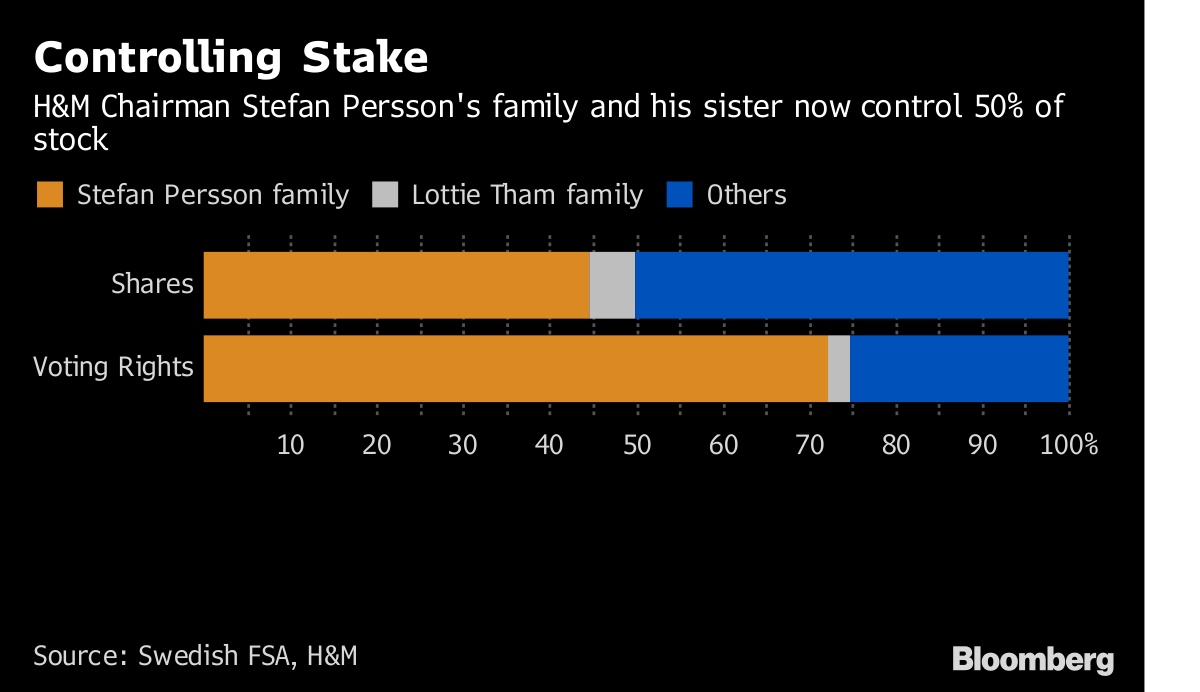

With those purchases, Persson and his family now control 44.5 percent of H&M, or 49.9 percent when combining his stake with the that of his sister, Lottie Tham and her family. Together, they held about 75 percent of H&M’s voting rights at the end of April.

Buying SpreeH&M's chairman has bought shares for 6.4 billion kronor in April and May

Source: Swedish Financial Supervisory Authority

.chart-js { display: none; }

The buying spree has fueled conjecture in local media that Persson may want to buy all of H&M and take it private. The chairman and his son, Chief Executive Officer Karl-Johan Persson, have consistently rejected that theory. Nils Vinge, H&M’s head of investor relations, says he’s not aware of any buyout plan.

Controlling StakeH&M Chairman Stefan Persson's family and his sister now control 50% of stock

Source: Swedish FSA, H&M

.chart-js { display: none; }

Some analysts think Persson is probably just reinvesting the dividend (roughly 7 billion kronor) he is getting from H&M this year. If that’s the case, he may soon have finished his share purchases.

Asa Wesshagen, who monitors companies at the Swedish Shareholders’ Association, says the Persson family isn’t known "for making quick deals," and points out that Persson has reinvested his dividend payments in a similar way in previous years.

But with Persson’s share purchases seeming to intensify, some analysts wonder whether this time might be different.

Though the likelihood of a family buyout ultimately isn’t that big, the latest buying spree by the chairman suggests it’s a bigger possibility now than a year ago, according to a Stockholm-based H&M analyst who asked not to be identified in line with company policy. The analyst said the family has the ability to pull off such a deal.

Joacim Olsson, the chief executive officer of the Swedish Shareholders’ Association, says the scenario can’t be ruled out, but is unlikely to happen within the next five years.

“If he continues to build his stake, I guess it wouldn’t take that much for him to buy it outright," Olsson said by phone. "But right now, we’re talking about huge amounts of money, if it were to happen."

With a market capitalization of about 240 billion kronor, H&M is the fifth-largest Swedish company. Taking it private would require about 120 billion kronor in funding to pay for the 50 percent of the shares that Persson and his sister don’t already own.

Wesshagen at the shareholders’ association says Persson has many options should he want to take H&M private. He could make a bid for the entire company himself, or team up with a private-equity firm to help with the financing. He could also have H&M start a share buy-back program, should its finances allow that, or let another company buy H&M and then take a stake in that firm.

A leveraged buyout may be unlikely, given H&M’s declared goal of having “a strong capital structure with strong liquidity and financial flexibility."

It’s worth noting that a Swedish rule requiring investors to make a formal bid if they acquire more than 30 percent of a company doesn’t apply to Persson. That’s because he already controlled more than that when the rule came into force more than a decade ago.

No comments:

Post a Comment